December 18, 2025

by

Kara Benton

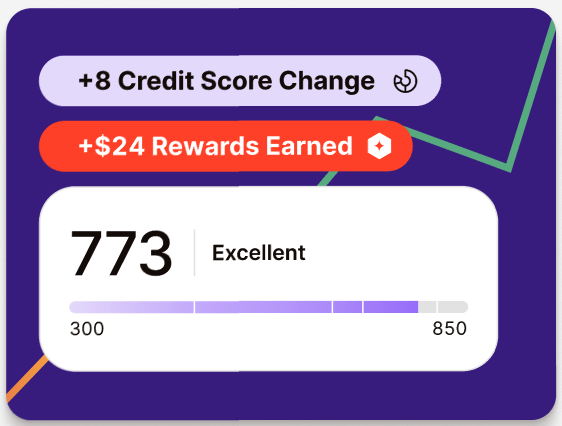

Now, Foyer+ members get access to a superior credit scoring model that can be more beneficial to buyers by giving them credit for more things, like rent payments. Work with our pros to improve your score, and get rewarded for each point you go up.

December 1, 2025

by

Kara Benton

This partnership represents a major milestone in our mission to save the dream of homeownership—and it means we'll have access to world-class behavioral science expertise to make our platform even more effective for the families we serve.

October 17, 2025

by

Landy Liu

If you're taking steps toward homeownership, understanding FHA loan requirements can unlock a more accessible path. FHA loans are backed by the Federal Housing Administration and designed to help buyers with moderate credit or limited savings. This guide walks you through everything: how FHA loans work, who qualifies, how much you’ll need, and how you can use Foyer to strengthen your readiness.

October 16, 2025

by

Landy Liu

In the United States, the concept of a First Home Savings Account (FHSA) is relatively new. Some states are introducing versions of it to help prospective first-time homebuyers build toward a down payment with tax incentives. In this article, you’ll find a clear breakdown of how contributions work in an American FHSA variant, the contribution limits, tax treatment, rules around overcontributions, and practical steps to contribute.

October 14, 2025

by

Landy Liu

You've decided you're ready to buy your first home. You've started looking at listings, maybe even attending open houses. Then reality hits: your credit score needs work before lenders will offer you the rates you want—or approve you at all.

October 2, 2025

by

Landy Liu

The dream of owning a home without a hefty upfront payment sounds too good to be true, but is it? If you're asking, "Can you buy a house with no money down?" the short answer is yes, but the reality is more nuanced. From government-backed loan programs to strategic financial planning, let's break down your real options.

September 25, 2025

by

Landy Liu

When you're ready to buy a home, your mortgage lender becomes more than just a line item, they're your financial co-pilot. But with so many types of lenders, terms, and offers to compare, how do you know who to trust? If you're a first-time homebuyer, choosing a lender can feel like stepping into a maze. Between interest rates, fees, jargon, and pressure to “act fast,” it’s easy to feel overwhelmed. But here’s the good news: with a little know-how (and the right questions), you can feel confident you're making the best choice for your future. In this guide, we’ll break down what mortgage lenders actually do, the types available, what to look for, and how to compare offers. We'll also show you how Foyer Pros can help match you with vetted lenders, so you don’t have to go it alone.

September 18, 2025

by

Landy Liu

For many first-time buyers facing rising home prices and stiff competition, coming up with a down payment feels harder than ever. So it’s no surprise that a growing number of hopeful homeowners are looking to their retirement savings, specifically, their 401(k), as a potential source of funds. But is tapping into your future financial security a smart move today? Let’s break down everything you need to know about using a 401(k) to buy a home: the rules, the risks, and the better alternatives. Before we answer whether you should, let’s address whether you even can use a 401k to buy a home.

September 11, 2025

by

Landy Liu

Credit scores play a crucial role in the mortgage approval process, particularly for first-time homebuyers trying to understand where they stand financially. While FICO has long been the most commonly used scoring model, the VantageScore has gained momentum in recent years, especially with its latest version now accepted for certain mortgage applications. Understanding how the VantageScore works, and how it differs from FICO, can provide buyers with a broader picture of their readiness to purchase a home.

August 29, 2025

by

Landy Liu

A First Home Savings Account (FHSA) is a type of account designed to help first-time buyers save money for a home with unique tax and financial advantages. In the US, FHSA programs are not federal, but several states offer versions of these accounts — allowing buyers to set aside funds for down payments and closing costs with tax benefits at the state level.

to stay up to date on homeownership news